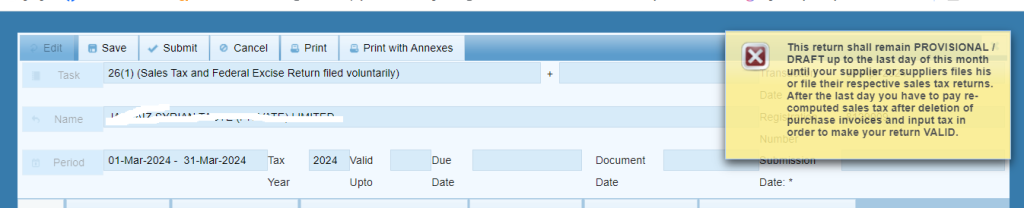

This return shall remain PROVISIONAL / DRAFT What should do?

Why i see This return shall remain PROVISIONAL / DRAFT up to the last day of this month until your supplier or suppliers files his or file their respective sales tax returns. After the last day you have to pay re-computed sales tax after deletion of purchase invoices and input tax in order to make your return VALID error duirng March 2024 sales tax filing?

At the purchase form the other company has not submitted his sales tax retrun.You cannot file your sales tax retrun.We have to wait until he submit his sales tax retrun.

What if he has not file his march 2024 sales tax return?

You cannot claim your sale tax credit as you have claimed in purchase part.You should delete and pay the tax.

If you need any help feel free to contact me.