How to file balance sheet for sales tax registered?

As per SRO 350(2024)(Statutory Regulatory Order). Due date filing of balance sheet was April 06, 2024.If you have not filed balance sheet you are unable to file sales tax retrun.

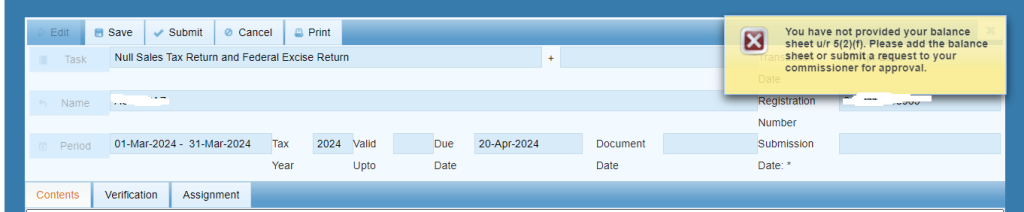

If you found this error what shoud you do?

You have not provided your balance sheet u/r 5(2)(f). Please add the balance sheet or submit a request to your commissioner for approval.

Who should file submit balance sheet with sales tax retruns ?

- Sales tax registerd Individuals

- Private Limited Companies

- Firms & AOPs

Who is exempt for the submission of sales tax retruns?

- Salaried Individuals

- Rental Income recients

- Unregistered sales tax persons

- Public limited companies

- income from dividens

- savings accounts holders

How to submit balance sheet 14(1) (Sales Tax registration modification to add the balance sheet u/r 5(2)(f)) (Sales Tax)?

- Login IRS acccount

- Click Registration Tab

- Forms

- 14(1) (Sales Tax registration modification to add the balance sheet u/r 5(2)(f)) (Sales Tax)

New page will open fill out all required info and attach balance sheet.If you are unable to file or know how to file balance sheet for sales tax registered?We can help you.