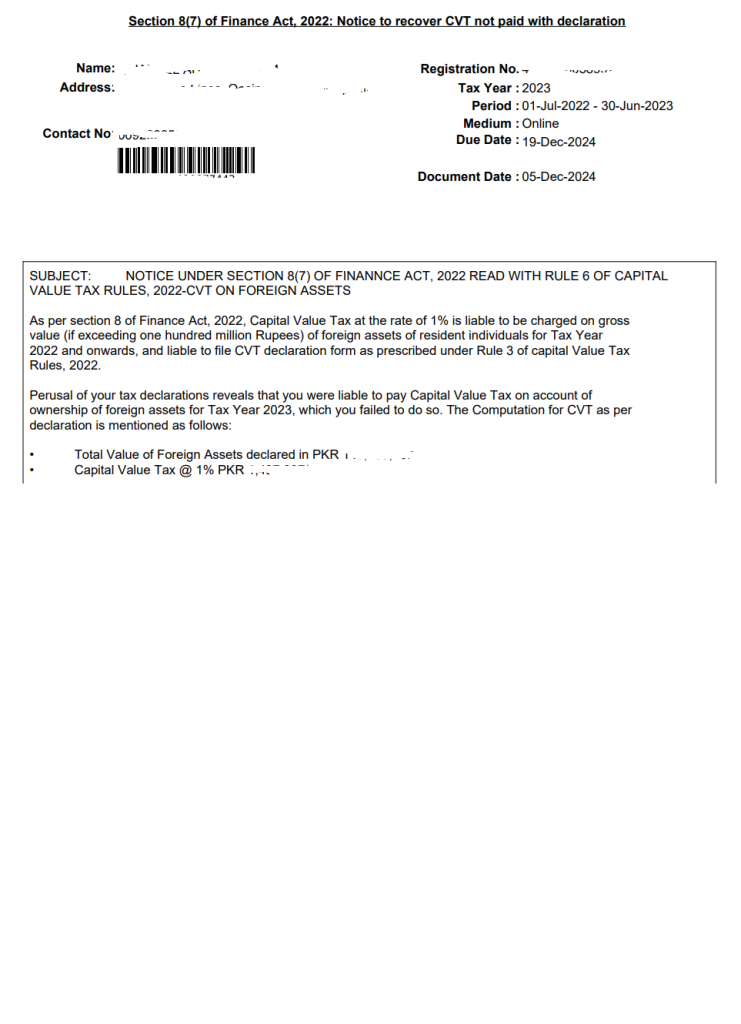

Section 8(7) of the Finance Act, 2022: Notice to Recover CVT Not Paid with Declaration

Have You Received a Notice Under Section 8(7) of the Finance Act, 2022 Read with Rule 6 of the Capital Value Tax Rules, 2022 - CVT on Foreign Assets?

If you received a notice under Section 8(7) of the Finance Act, 2022 about the recovery of Capital Value Tax (CVT) not paid with your declaration, it is important to understand why the notice was issued and what steps you need to take.

It is essential to respond within the given time frame to avoid further penalties or actions.

Why Did I Receive a Notice Under Section 8(7) of the Finance Act, 2022 for CVT on Foreign Assets?

Section 8 of the Finance Act, 2022 requires a Capital Value Tax (CVT) of 1% to be levied on the gross value of foreign assets owned by resident individuals if the total value exceeds one hundred million Rupees. This tax applies to the Tax Year 2022 and beyond. To comply, you must file a CVT declaration form as outlined in Rule 3 of the Capital Value Tax Rules, 2022. Sample Calculation of CVT:- Total Value of Foreign Assets Declared: PKR XXX

- Capital Value Tax (1%): PKR XXX

What Does This Notice Mean for You?

Section 8(7) of the Finance Act, 2022, read with Rule 6 of the Capital Value Tax Rules, 2022, allows you to explain why the CVT and any default surcharge should not be recovered from you

Your Responsibility

You must pay any taxable liability according to the law. If you have not paid the CVT on your foreign assets as required in your declaration, you should take immediate action to correct this and avoid potential legal issues.How to Proceed

If you received this notice and need help, seek professional advice or legal guidance. This will help ensure you comply with the regulations and protect your rights. Section 8(7) of the Finance Act, 2022: Notice to Recover CVT Not Paid with Declaration If you have any concerns or questions about Section 8(7) of the Finance Act, 2022, or the recovery of CVT not paid with your declaration, contact us for expert guidance and support. Make sure you fully understand your obligations under the Finance Act, 2022, and take prompt action to resolve any discrepancies related to your CVT declaration.